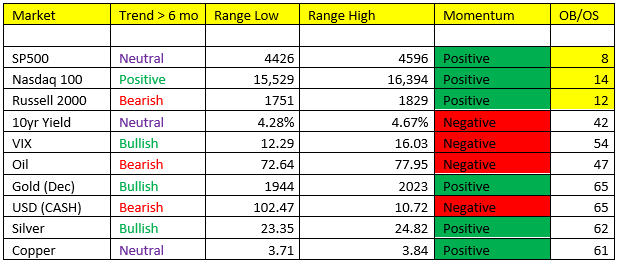

Market Risk:

*New Home Sales fell -18% yy on Monday

*Report: OPEC talks are difficult and close to reaching impasse – a further delay is possible/policy rollover is possible.

*ECBs Nagel: rate hikes are not necessarily over. We would have to hike again if inflation worsened. – Euro continues to gain on the USD on suspected divergence in Central Bank policy.

*Consumer Confidence due up at 9am

Volatility/Narratives/Etc. – unnatural low volatility continues to feed equities. The current narrative on Wall Street is that the Fed is done, the next move will be a rate CUT, and equities will glide path higher the entire way. I think what many fail to understand and underestimate is the conditions that would necessitate a rate cut in the first place. For example, a slowing economy, falling equity prices, credit tightening. With the right catalyst, sure I could see the Fed cutting rates in 2024 – however absent any catalyst …. No, I don’t see it happening and it would be “higher for longer” on rates. However, we continue to maintain evidence that suggests economic conditions will be demonstrably tighter in Q1/Q2 of 2024.

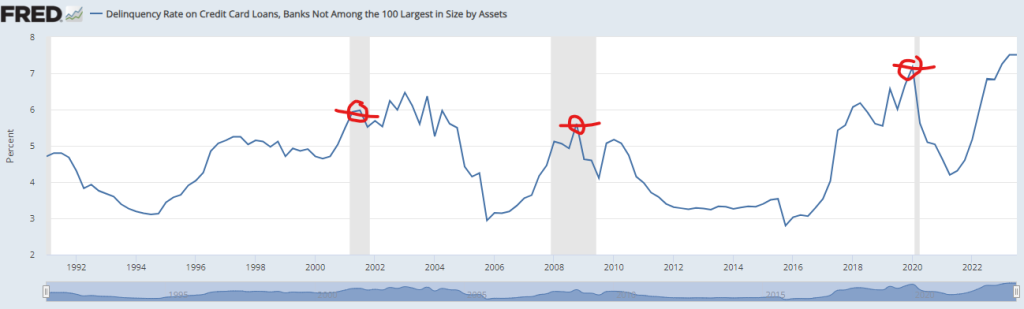

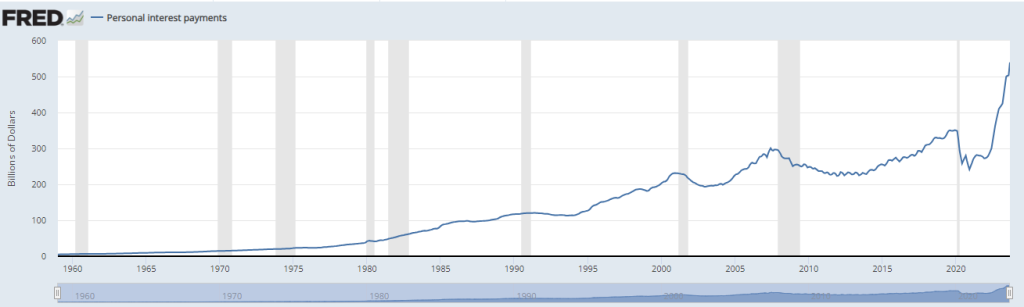

The Consumer: We continue to hear “the consumer is strong” narrative. And by looking at “Black Friday” sales data you’d surmise that that were true. Record sales of $9.8B was spent over the weekend. However, “buy now pay later” was up an astonishing +47% YY. Let’s check on the health of consumer credit (listed in the charts below).

Credit card balances are at 30yr + highs….

Credit Card delinquency rates are at 30+ yr highs (higher than the previous 3 recessions)…..

Interest payments are going parabolic ….

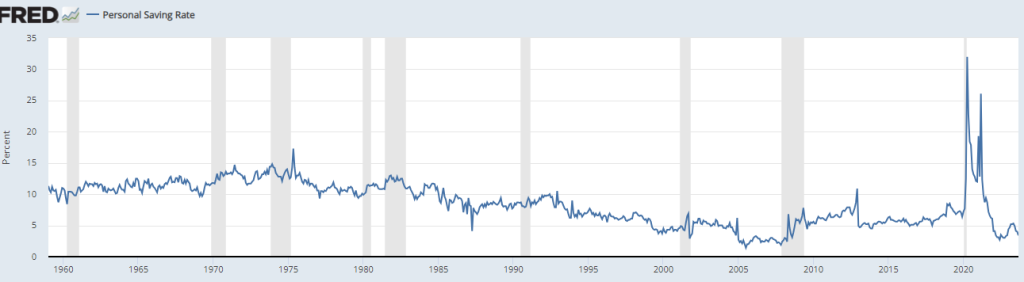

Saving’s rates are at multi-decade LOWS! …..

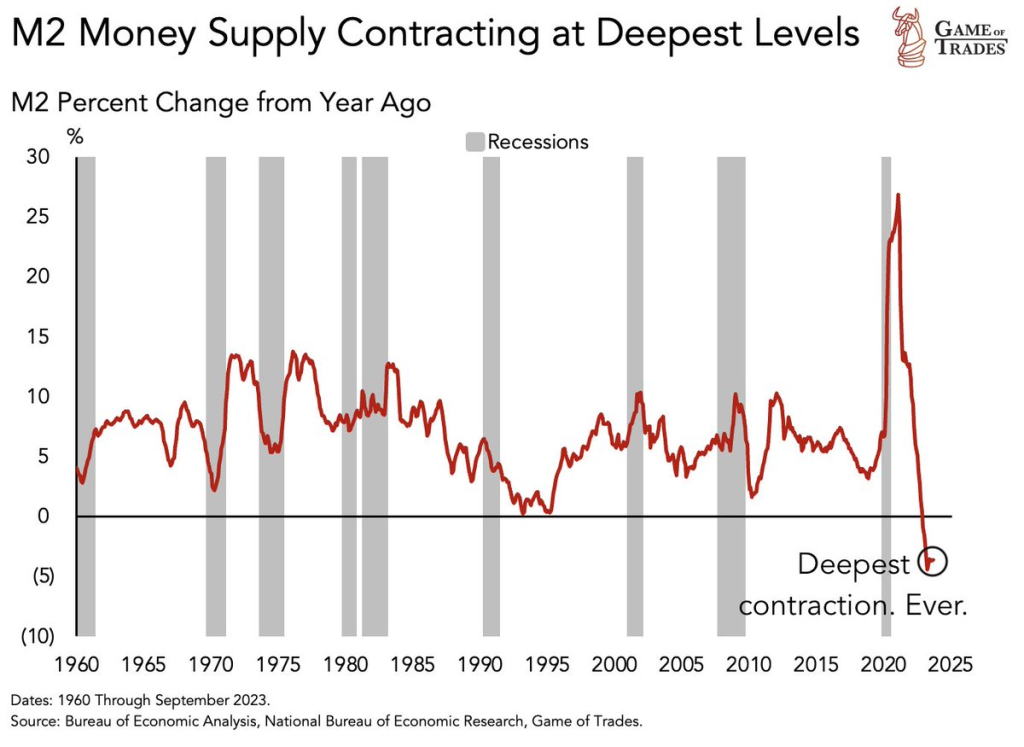

And Finally (posted on Game of Trades Macro research site) – M2 Money Supply contraction YY is the steepest decline EVER. Ever I remind you is a LONG TIME.

Top Long Macro positions – Gold, UST 2yr, Silver

Top Short Macro positions – Russell 2000 (small cap index)

Stocks: divergence, now signaling OS.

Gold: taking out a key resistance area into expiration of December contract. Remains Bullish trend, Positive momentum, and

Bonds: We added 2yr Notes yesterday – may be a relatively subdued trade for a while, however yields could fall into January from here – need to continue to watch inflation data going forward.

Dollar: negative divergence continues to suggest SELL the USD vs Foreign’s and……GOLD.